MDMOne — Mobile Device Financing & Control Platform

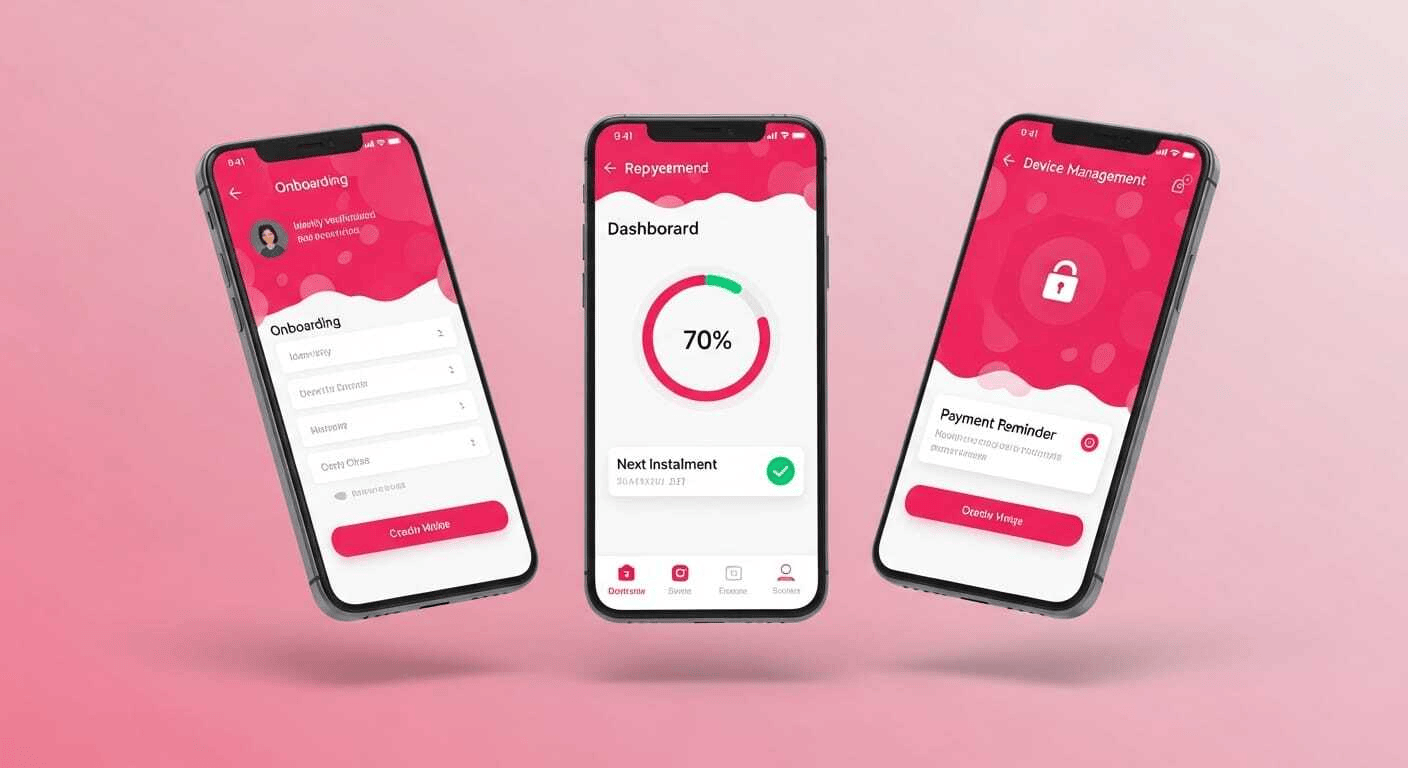

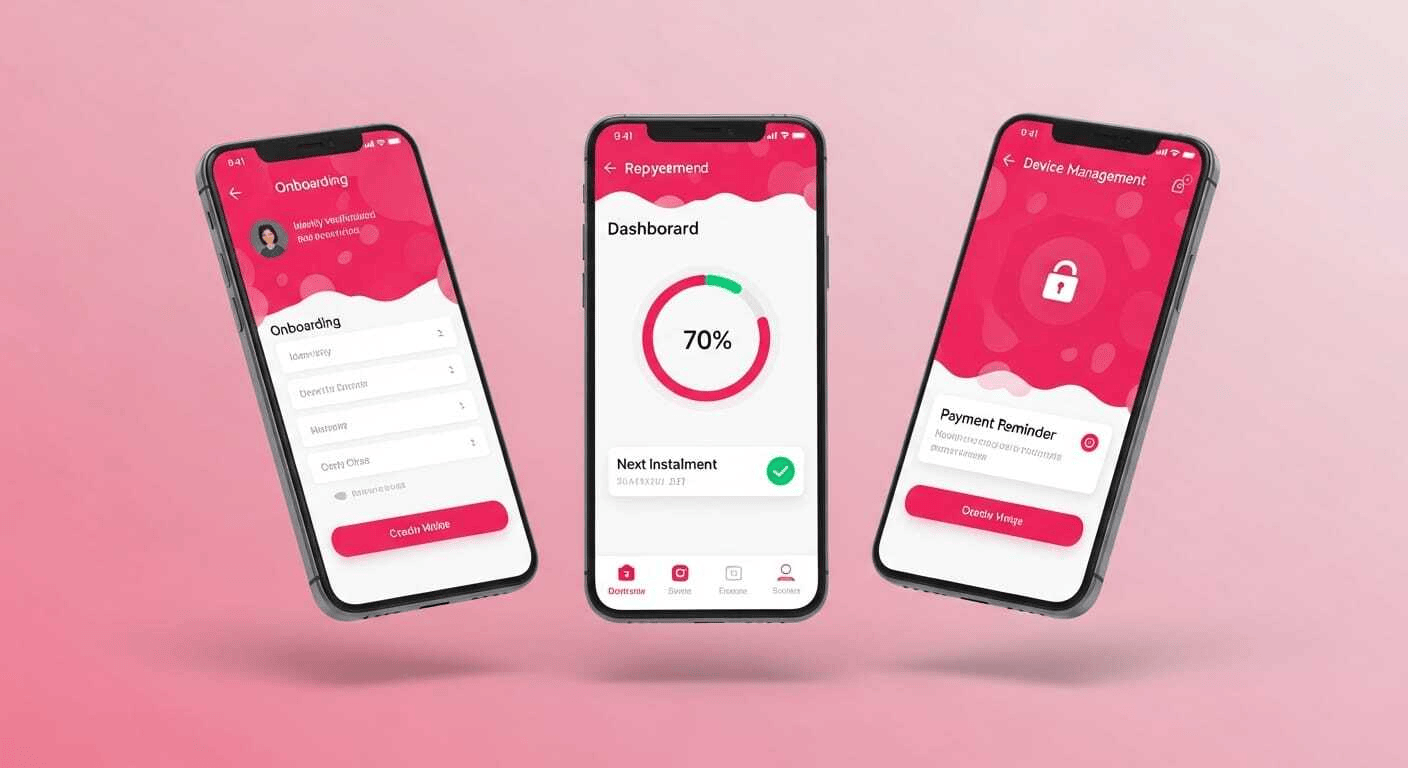

MDMOne developed a secure Android mobile application designed to support smartphone financing programs while enforcing device-level management and compliance controls. The platform enables seamless onboarding, credit eligibility checks, repayment tracking, and automated enforcement of device policies within a single mobile experience.

The solution combines mobile finance workflows with enterprise-grade MDM capabilities to ensure responsible device usage and repayment compliance.

The Challenge

Financed device programs face operational and security risks:

Managing repayment compliance at scale

Preventing device tampering or misuse

Ensuring secure onboarding and credit profiling

Sending timely repayment reminders and alerts

Enforcing usage restrictions when required

The solution needed to integrate financing operations with device-level enforcement in a scalable way.

The Solution

MDMOne delivered a mobile-first financing app with built-in device management controls.

Key capabilities included:

Digital onboarding and credit assessment

Repayment tracking and installment reminders

Push notifications for payment alerts

Conditional device restrictions tied to compliance

Remote policy enforcement and usage control

Devices remain fully operational when compliant and can be restricted automatically when repayment conditions are not met.

Architecture Overview

User Onboarding

→ Credit Evaluation

→ Device Enrollment

→ Repayment Monitoring

→ Policy Enforcement

→ Access Restoration Upon Compliance

Technology Stack

Platform: Android

Device Management: Device Owner APIs

Notifications: Firebase Cloud Messaging

Architecture: Cloud-synced mobile application

Security: Encrypted data transmission & policy enforcement

Business Impact

Improved repayment compliance

Reduced device misuse and tampering

Faster onboarding and eligibility decisions

Centralized control over financed devices

Scalable foundation for expansion

Key Takeaway

Successful device financing programs require more than payment tracking—they require integrated device-level control. MDMOne demonstrates how mobile finance and MDM enforcement can work together to reduce risk and improve operational efficiency.

The Challenge

Financed device programs face operational and security risks:

Managing repayment compliance at scale

Preventing device tampering or misuse

Ensuring secure onboarding and credit profiling

Sending timely repayment reminders and alerts

Enforcing usage restrictions when required

The solution needed to integrate financing operations with device-level enforcement in a scalable way.

The Solution

MDMOne delivered a mobile-first financing app with built-in device management controls.

Key capabilities included:

Digital onboarding and credit assessment

Repayment tracking and installment reminders

Push notifications for payment alerts

Conditional device restrictions tied to compliance

Remote policy enforcement and usage control

Devices remain fully operational when compliant and can be restricted automatically when repayment conditions are not met.

Architecture Overview

User Onboarding

→ Credit Evaluation

→ Device Enrollment

→ Repayment Monitoring

→ Policy Enforcement

→ Access Restoration Upon Compliance

Technology Stack

Platform: Android

Device Management: Device Owner APIs

Notifications: Firebase Cloud Messaging

Architecture: Cloud-synced mobile application

Security: Encrypted data transmission & policy enforcement

Business Impact

Improved repayment compliance

Reduced device misuse and tampering

Faster onboarding and eligibility decisions

Centralized control over financed devices

Scalable foundation for expansion

Key Takeaway

Successful device financing programs require more than payment tracking—they require integrated device-level control. MDMOne demonstrates how mobile finance and MDM enforcement can work together to reduce risk and improve operational efficiency.

More projects

Get in touch

+91 90419-59799

#337, Sushma Infinium Adjoining Best Price Chandigarh - Delhi, NH - 22, Zirakpur, Punjab